**Tax Alert**

SPECIAL NOTICE:

- All returns are extended automatically to July 15, 2020 per IRS.

- 1st quarter estimated tax payments are also due on that date.

Note – click an image to download the PDF

Important Links

- CDC: Coronavirus (COVID-19) Information

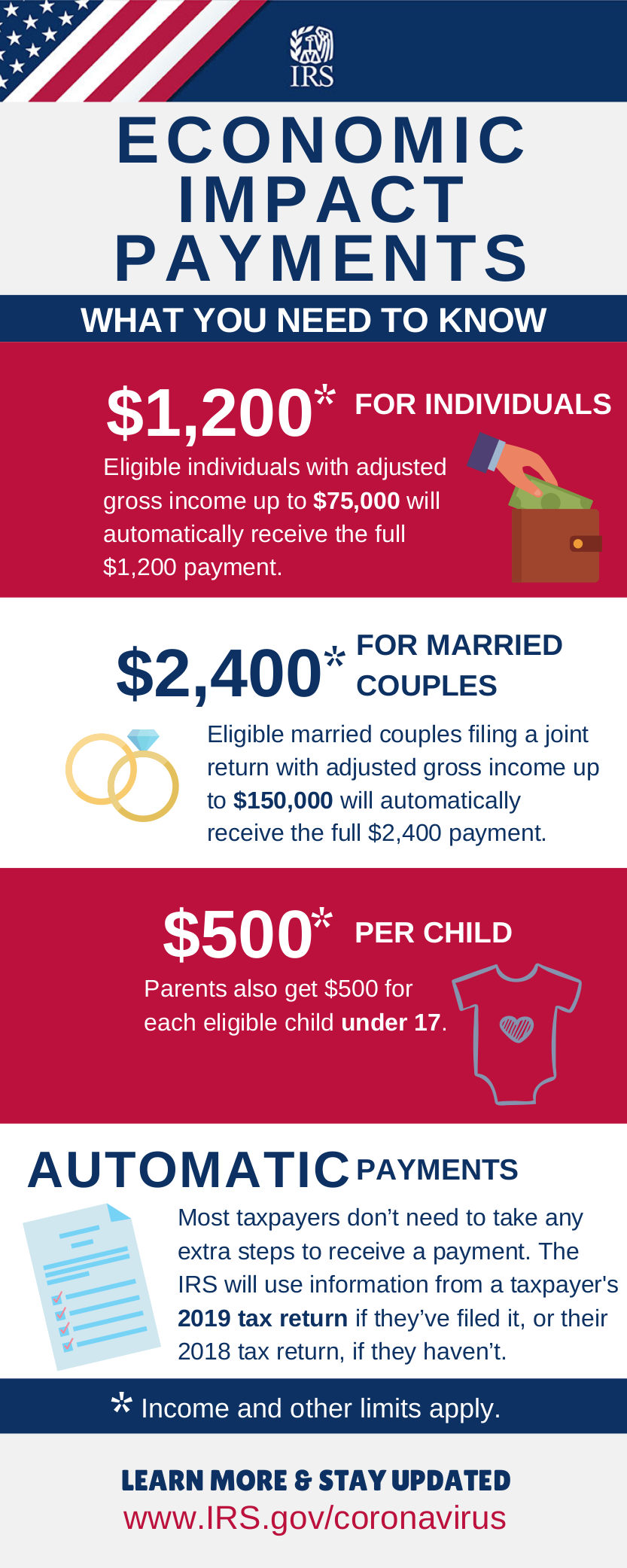

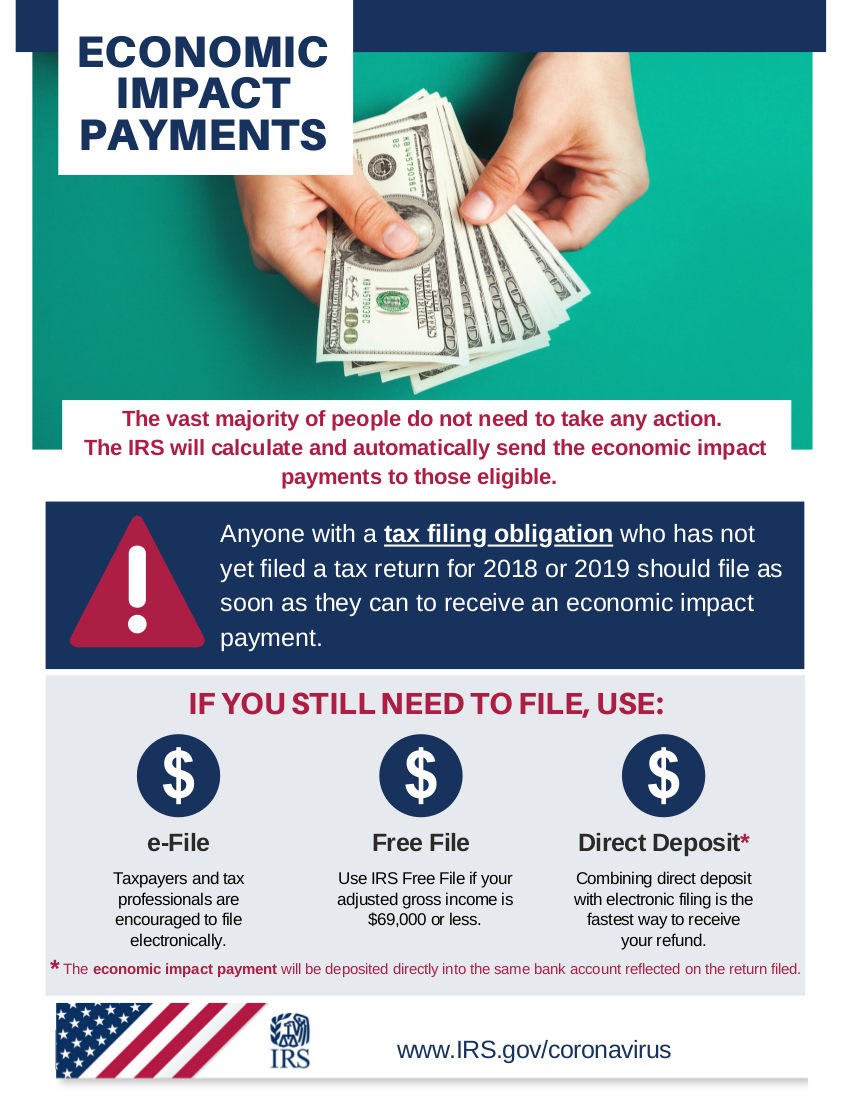

- IRS Coronavirus Tax Relief and Economic Impact Payments

- U.S. Small Business Administration: Our nation’s small businesses are facing an unprecedented economic disruption due to the Coronavirus (COVID-19) outbreak. On Friday, March 27, 2020, the President signed into law the CARES Act, which contains $376 billion in relief for American workers and small businesses.

Funding Options

In addition to traditional SBA funding programs, the CARES Act established several new temporary programs to address the COVID-19 outbreak. Visit their Coronavirus Relief Options page for all your options.